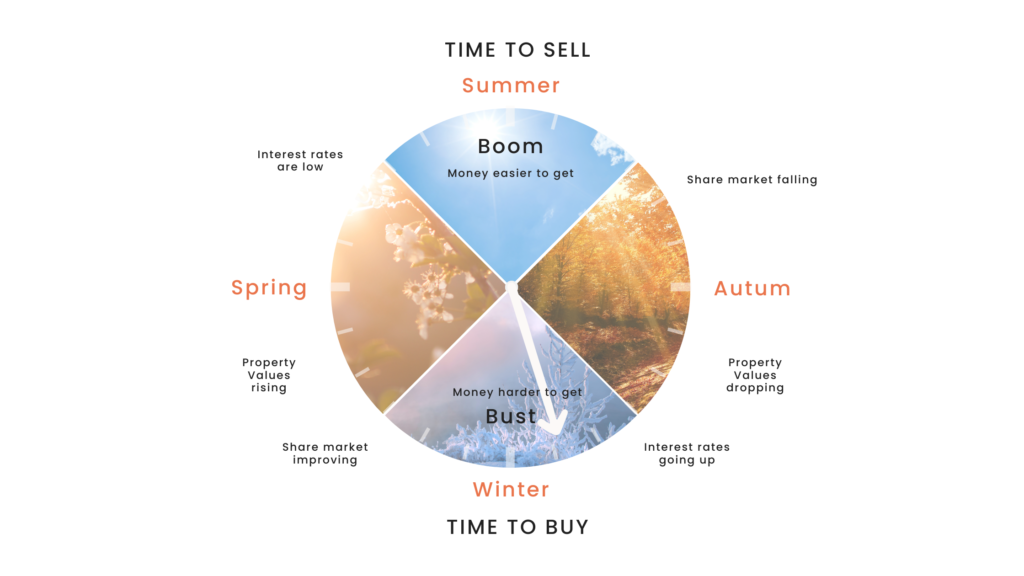

The property market can be viewed as a cyclical system. Over time it has proven to increase in value by approximately 6 to 7% per year. But that increase does not occur in a linear way. We describe it as fluctuating up and down according to the cycle of seasons shown in the diagram below. We think we are currently in the winter season of the cycle. Typically, in this period, interest rates are higher, loans are harder to get, stock markets are uncertain, and property buyers are fewer.

What’s happening with house prices?

The quarterly median price for a house sold in Kerikeri during the 3 months ending April was $1,080,000. That is up 18% from the same period 1 year ago and up 48% from 3 years ago. It represents a new peak in median price. However, the stats in this case are not telling the full story. The distribution of sales has become skewed to the higher end of the price spectrum as lower price properties are currently not selling as well. A change in the mix of properties sold between one comparison period and another can make apples to apples comparisons challenging.

So, we rely on other information to assess how market pricing is being affected. Listing and selling properties at the coal face, we are seeing vendors accept robust appraisal prices more often, reduce their pricing expectations after launch and prepared to negotiate with buyers. As a result, sale prices achieved are between 5 and 10% below the listings price after negotiations. We suspect that our true median price is 5 to 10% below the peak level achieved last year. Older properties may have dropped more than that as newer-built property prices are being propped up by construction costs and replacement values.

By comparison Auckland and Wellington regions are down 22% and 20% respectively from their peak values reached in 4th quarter 2021 and have effectively wiped out any price gains since December 2020.

What are the market drivers?

Negative:

- Weather related closing of roads has made it difficult for buyers to get here.

- Residential investors are sitting on the fence awaiting the election and hoping for regulatory changes.

Positive:

- Net migration into New Zealand has increased which usually helps to displace people from the cities to the provinces after a time.

- The attractiveness of Kerikeri as a place to retire or move to for a better lifestyle

How are the number of sales tracking?

There were 92 unconditional residential, lifestyle home and bare land sales in the Kerikeri and surrounds area through the end of May 2023. This represents a 30% decrease in sales volume from the 131 sales for the same period last year.

Bare land sales are significantly down 70% from 17 through May 2022 to only 5 in the same period this year. There are 6 years of bare land inventory on the market at the current pace of sales. We expect this to impact the number of local building consents and new house starts. Nationally building consents are down 26%.

How long is it taking to sell?

The average number of days to sell has risen above the 10-year average sitting around 70 and is rising each month. Vendors have to adjust to the reality that their property could take 6 months to a year to sell (in some price brackets longer), especially if they are not competitively priced.

How are inventory levels tracking?

Inventory levels are up to 285 unique listings for sale on Trade Me in May. This level has been holding steady for most of the year as some owners have withdrawn properties from the market after not having sold making up the difference between the higher number of monthly new listings versus properties sold.

*Greater Kerikeri approximated the Kerikeri High School enrolment zone and includes Waipapa, Doves Bay Peninsula, Inlet Road Peninsula, Kapiro, Waimate North Road and branch roads, Wiroa Rd and branch roads, Pungaere Rd and branch roads, Puketotara Rd and branch roads, Waipapa West Road and branch roads, Takou Bay.

**We use quarterly moving averages as these mitigate some of the wild monthly variation that occurs when reporting monthly medians on smaller number of sales.